Why we built CryptoAdvisor.Club?

You probably know WHAT we do. Now let's talk about our vision and motivation.

A passive and automatic investment mindset

We’ve been interested in passive and automatic investment strategies for over ten years now and found some products, tools, and habits on the way that were effective for that approach: Invest in well-balanced indexed funds, make periodic deposits to help establish good saving habits, and define clear criteria and strategies to design our portfolios while following a rigorous method to manage it.

The last point is one of the most important things, to avoid ending up making impulsive investment decisions on bullish/bearish market periods.

The right tools can help us attach to a methodology

Tools like Trello / Things or any other task-management solution can help you follow the Getting Things Done method. Similarly, other good tools can help you with your passive/automatic investment strategies. For instance, in the case of indexed funds, there are tools like Indexa Capital or MyInvestor that help you design well-balanced portfolios and automate tasks like periodic re-balancing to keep your chosen risk profile (removing the “emotional” part in those decisions).

If we think about stock investment, some tools (algorithms) like Automatic Investment Machine (AIM) or Twinvest from Robert Lichello can help you define criteria to analyze the market evolution and give you suggestions to buy or sell.

Trying to translate all of this into the crypto world

In the crypto world, there are many “trading bots” that automatically analyze the prices in real-time and buy and sell cryptos for you.

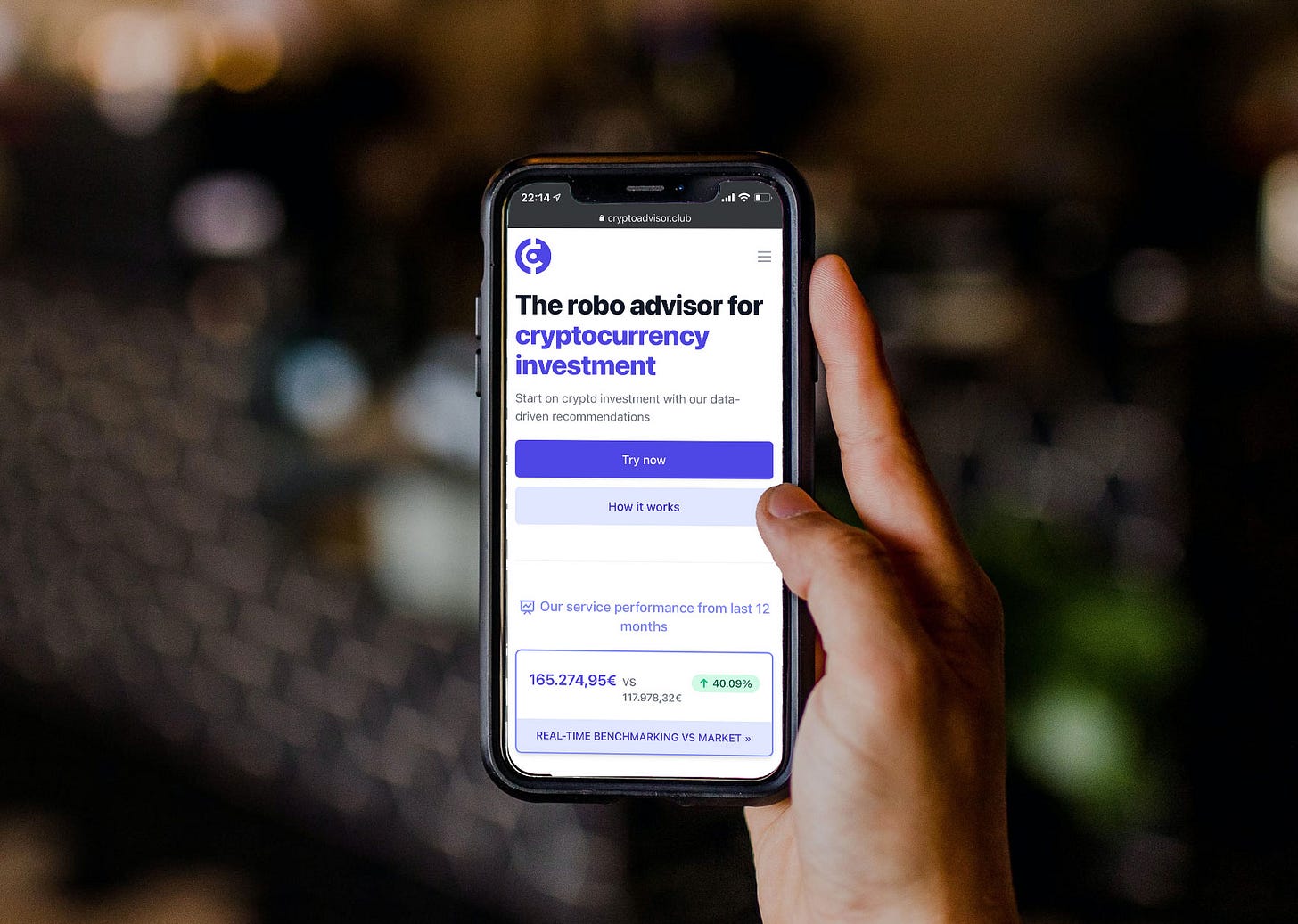

CryptoAdvisor.Club takes a different approach to investment and shares very little with other tools. To begin with, we don’t operate directly with the money. We want to help you make better investment decisions more easily and clearly. We want to automatize your investment decisions, not the operations. You’ll be always in full control.

What we are trying to achieve:

Healthy schedule. The bot recommendations don’t come on price changes and sudden changes (although you can receive alerts if you want to). Instead, it builds a healthy weekly schedule and suggests you operate when necessary after evaluating longer time windows.

Education & Transparency. We want you to learn from the cryptocurrency world, one step at a time, and help you build a critical spirit while walking in the path. Our bot will always justify the WHY when it recommends buying or selling a specific amount of crypto in your portfolio. Although you might expect something different, most of the time, the best advice is to do nothing.

Passive/automatic investment mindset adapted to cryptos nature: CryptoAdvisor.Club adapts algorithms like AIM to the high price volatility of cryptocurrencies, trying to optimize operations for the long term. We take a clear position, trusting in the future progressive adoption and price increases.

This means that it will recommend you to get some profit in the high price rising scenarios, and will be especially sensitive to recommend you buy on price drops.Reproducible behavior. We have published our benchmark, which is calculated on the fly every time applying our algorithm. Take a screenshot today and see the difference in a few days (for good or bad).

In summary, CryptoAdvisor.Club is a tool to ease the pain and trouble of crypto investment in a complicated world. And we work every day to make it even easier and more clever.

Already a user? Having doubts? We’d ❤️ to hear your feedback. Just drop us a line at hello@cryptoadvisor.club or using the /feedback command from the bot itself.