Try Automatic Investment Machine (AIM) Lichello's algorithm in a Google Sheet

Do you want to see how original Robert Lichello's AIM work?

As we explained some weeks ago, our Premium services include the use of our recommendations algorithm, a variation of Robert Lichello’s Automatic Investment Machine (AIM) algorithm1. We’ve adapted the original formula to our opinionated vision of the cryptocurrency market, making it more sensitive to buying opportunities (not only in terms of price thresholds) and optimizing it for a mid & long-term buy & hold strategy.

We strongly believe that the algorithm itself is not the primary value of our service, but helping our customers implement some healthy investment habits that include periodicity and objective -not impulsive- and data-driven decisions. Of course, our recommendation algorithm is an important part of the tools we use for that objective.

Still, even looking only at the algorithm itself, we try to go further: making it easy to consume its output through our bot, applying it to a full portfolio -combining multiple coins and their representativity of each one over our available funds-, allowing our customers to follow their portfolio evolution & performance VS market over time…

So, we’ve decided to openly share a tool in a Google Sheet to show you how original Lichello’s AIM works. 2

The basics

First, you’ll see two tabs, one for testing AIM with Stocks (connected to Google Finance data) and one for testing with Cryptos (connected to Coinbase API)

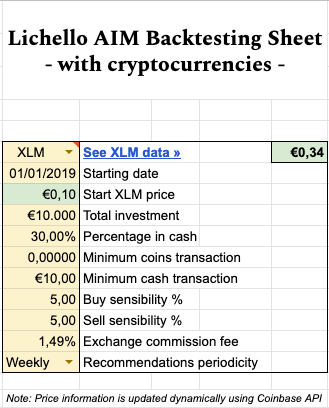

On the top-left side of the document, you’ll find this table. You can modify all cells painted yellow:

The selected coin (Stellar -

XLM- in the example): You can choose one of the coins listed in the drop-down or introduce the crypto code of your choice.The starting date for the backtesting: it will automatically update the backtesting results table below.

Total investment: in combination with the Percentage in cash, it will determine the backtesting's starting point. Will be divided between “available cash” and “cryptocurrencies”.

Minimums: you can define a minimum amount of coins/shares or € to generate a recommendation

Buy/sell sensibility: the price change % that should be detected to calculate recommendations.

Exchange commission fee: It will affect the resulting cash after a transaction, so in the case of cryptocurrencies, it considers your exchange fees in the results.

Recommendations periodicity: You can change the time interval to decide when you want to calculate recommendations. Every month, week, or day.

After every change, you’ll see that the data table below will change accordingly.

The data table

The data table includes one row for every “execution”, from the “starting date” selected previously until the current day, following the chosen interval.

Some of the main columns include:

Columns D-H will show you the price corresponding to the date on column C, and the main balances: assets quantity, their value in €, the amount in cash, and the aggregated value or assets & cash.

Column Q (AIM) shows you the raw result of the AIM recommendation, without applying any limits. The minimum limits are calculated then in the following R-U columns.

Columns V-W include the final recommendation, after applying previous limits. The recommendations are expressed both in terms of quantity of assets and amount in €.

Finally, columns X-AA include the final action taken. Since one of the goals of this document is to execute backtesting over past historical data, we fill automatically the date in those columns based on the eventual formula recommendation.

The last AB-AD columns simply apply the results of taking investment actions to previous balances, so the next row can take into consideration.

The results

In the top-center of the table, you’ll find the aggregated calculations from the data table, that will tell you:

The earnings (or losses) in € in the given period

The percentage profitability of the AIM formula for the given data

The percentage of profitability of assets if we wouldn’t apply any recommendation, simply holding the starting balance over the given period.

And finally answering two simple questions:

Would you have earned money following the AIM advice?

Would you’ve beaten the market if you’d followed that advice? That means: would you’ve earned more money following the advice than simply holding the assets?

What we liked the most from Lichello’s approach with his original formula? It adapts to mid & long-term investment strategies. It protects you against one of the main risks for average investors: selling at lows and buying at highs. Is a data-driven method, unaffected by rumors and trends. It works better with volatile assets.

And those really interesting features make us use it for several years on our stock investments, and finally encouraged us to investigate how we could adapt it to make it perform better, specifically talking about crypto assets, and fit in our vision. So we started working on what would finally become CryptoAdvisor.Club service. 🙂

If you aren’t a premium subscriber yet, you can try our service for free for two months using the discount coupon: “WELCOME”.

Make better investment decisions in crypto with CryptoAdvisor.Club »

Take into account that this Google Sheet implements the original formula, not CryptoAdvisor.Club service variation. But still, we think it could be useful to check & learn.

how do I subscribe or get access to

Automatic Investment Machine (AIM) Lichello's algorithm in a Google Sheet